Page 31 - Beverage MasterFebMarch 2021_Update

P. 31

Craft Brewery

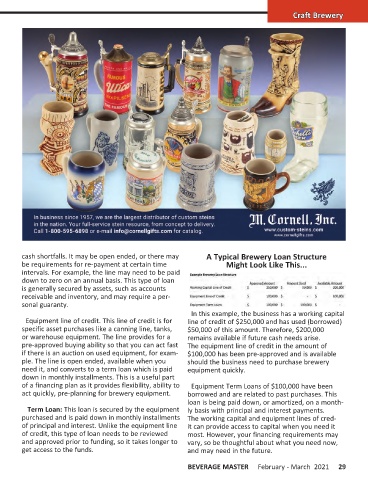

cash shortfalls. It may be open ended, or there may A Typical Brewery Loan Structure

be requirements for re-payment at certain time Might Look Like This...

intervals. For example, the line may need to be paid

down to zero on an annual basis. This type of loan

is generally secured by assets, such as accounts

receivable and inventory, and may require a per-

sonal guaranty.

In this example, the business has a working capital

Equipment line of credit. This line of credit is for line of credit of $250,000 and has used (borrowed)

specific asset purchases like a canning line, tanks, $50,000 of this amount. Therefore, $200,000

or warehouse equipment. The line provides for a remains available if future cash needs arise.

pre-approved buying ability so that you can act fast The equipment line of credit in the amount of

if there is an auction on used equipment, for exam- $100,000 has been pre-approved and is available

ple. The line is open ended, available when you should the business need to purchase brewery

need it, and converts to a term loan which is paid equipment quickly.

down in monthly installments. This is a useful part

of a financing plan as it provides flexibility, ability to Equipment Term Loans of $100,000 have been

act quickly, pre-planning for brewery equipment. borrowed and are related to past purchases. This

loan is being paid down, or amortized, on a month-

Term Loan: This loan is secured by the equipment ly basis with principal and interest payments.

purchased and is paid down in monthly installments The working capital and equipment lines of cred-

of principal and interest. Unlike the equipment line it can provide access to capital when you need it

of credit, this type of loan needs to be reviewed most. However, your financing requirements may

and approved prior to funding, so it takes longer to vary, so be thoughtful about what you need now,

get access to the funds. and may need in the future.

BEVERAGE MASTER February - March 2021 29

BM020321 Main Pages copy.indd 29 1/22/21 2:31 PM