If a brand new brewery doesn’t have ALL the beer at open give ‘em a break.

Listen now: Drink your beer with kindness #beerbrewing #beer #brewery #podcast

If a brand new brewery doesn’t have ALL the beer at open give ‘em a break.

Listen now: Drink your beer with kindness #beerbrewing #beer #brewery #podcast

In today’s podcast we dig into the “state of beer” with economist Lester Jones, separating structural shifts from cyclical noise and outlining a practical playbook to drive sales growth.

From broken pricing elasticity to on-premise strategy and demographics, we share data and specific moves.

If you love graphs, charts and spreadsheets (as I do), download Lester’s Beer Industry Update presentation deck.

Key Topics:

• industry volumes down and dollars soft

• structural vs cyclical drivers shaping demand

• beer purchasers’ index sentiment and signals

• pricing power fading and elasticity reset needed

• on-premise momentum, draft advantages, happy hour value

• occasion-led strategy with low and no alcohol

• demographics by life stage, not generations

• policy confusion on tariffs and taxation

• action playbook for wholesalers and brewers

Resources:

By: John Angus

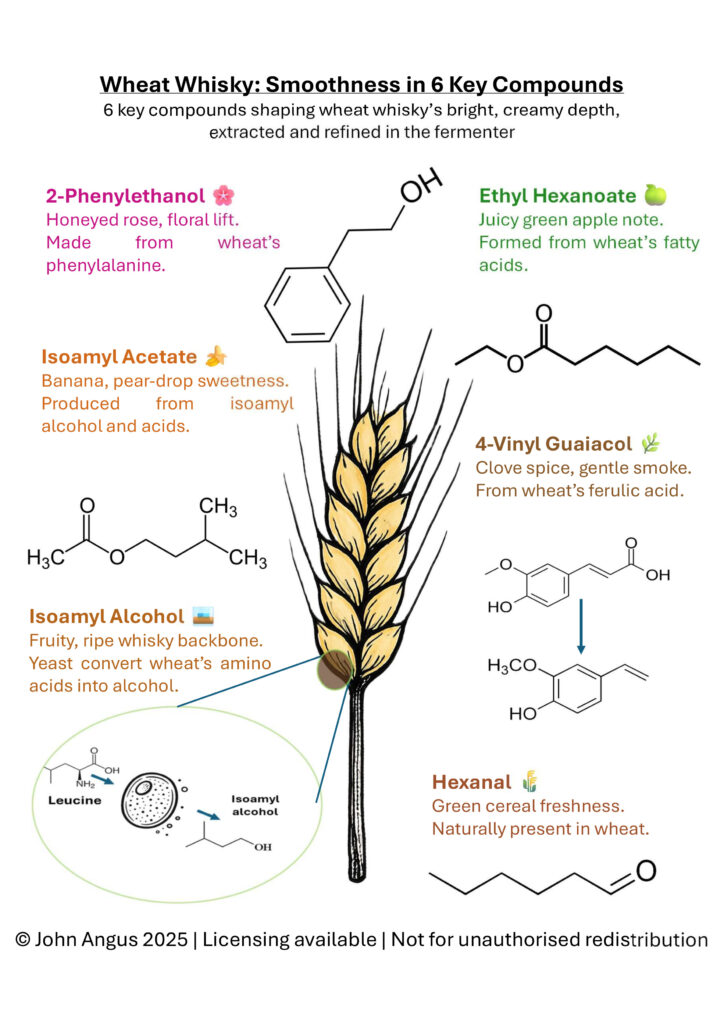

At the end of February, I shared my first post on whisky flavour chemistry. It was meant as a small experiment.

I wanted to see if breaking complex science into clear, visual stories could help others understand what really shapes a spirit. What I didn’t expect was how far it would reach.

Since then, Spirit Chemistry has grown into a community of over 15,900 people. Distillers, educators and flavour-curious readers from all over the world. What started as one post has become a long-term project to map how chemistry becomes flavour.

To make it easier for people to follow along, I’ve brought everything together in one place.

📘 Payhip Visual Library – over 70 flavour science infographics used for training and education https://payhip.com/SpiritChemistry

🧪 Substack Newsletter – The Distilled Edit – weekly deep dives that go beyond the posts https://substack.com/@spiritchemistry

Both are free to explore and capture everything I’ve been learning and sharing since this began.

How I’ve structured it

To make flavour science easier to follow, I’ve broken it down into mini series. Each one explores a different stage of production or a specific theme. Together they show how chemistry becomes taste.

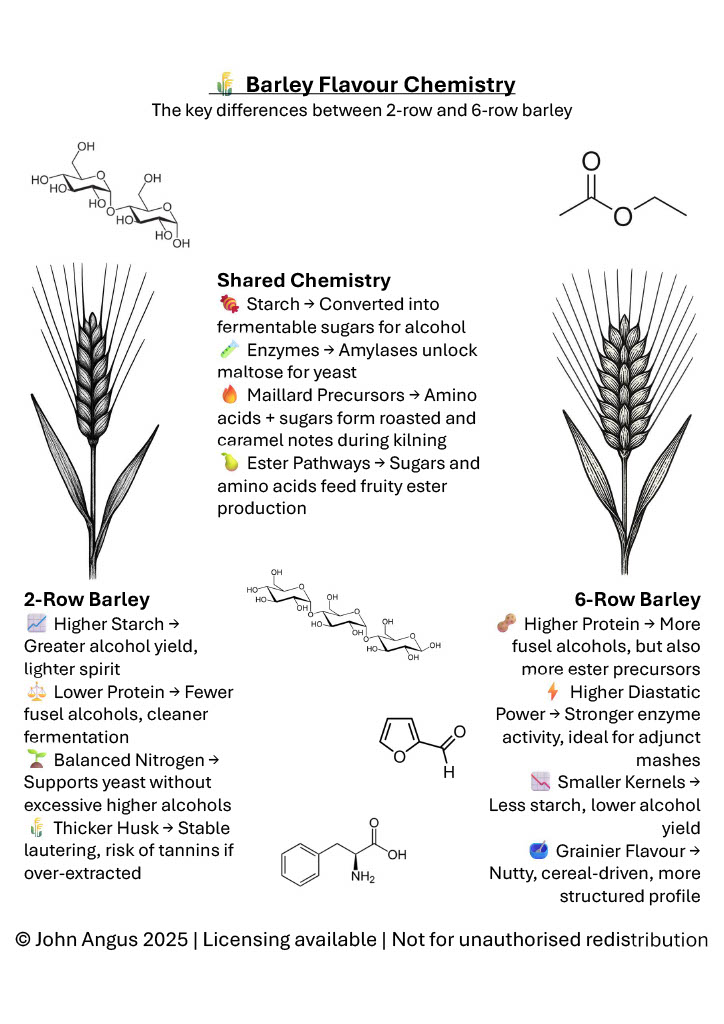

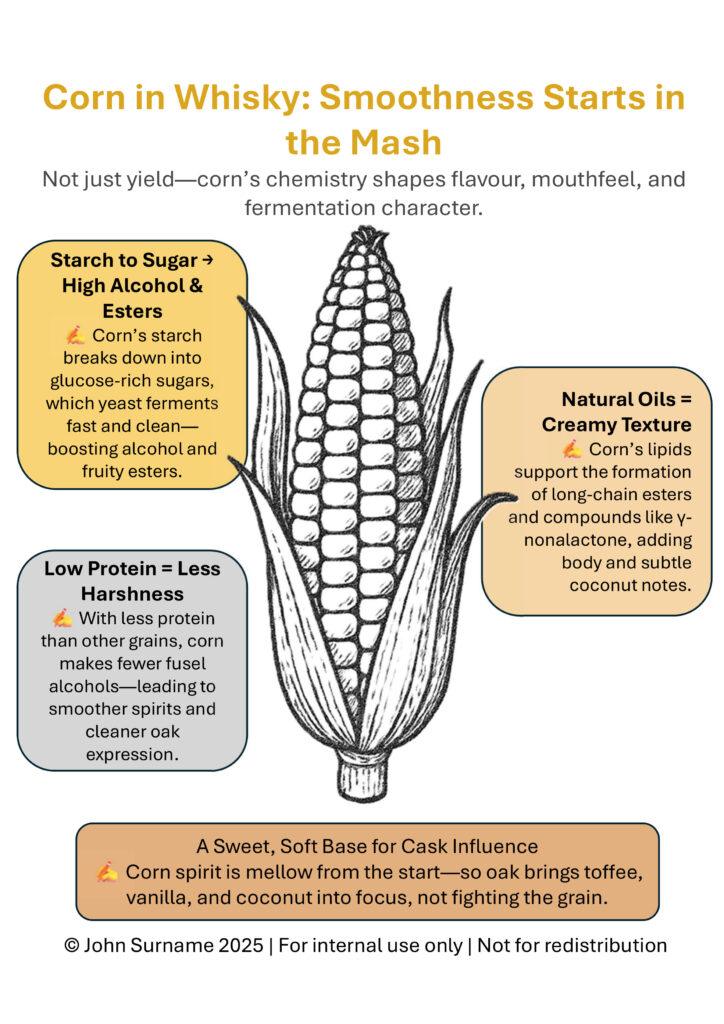

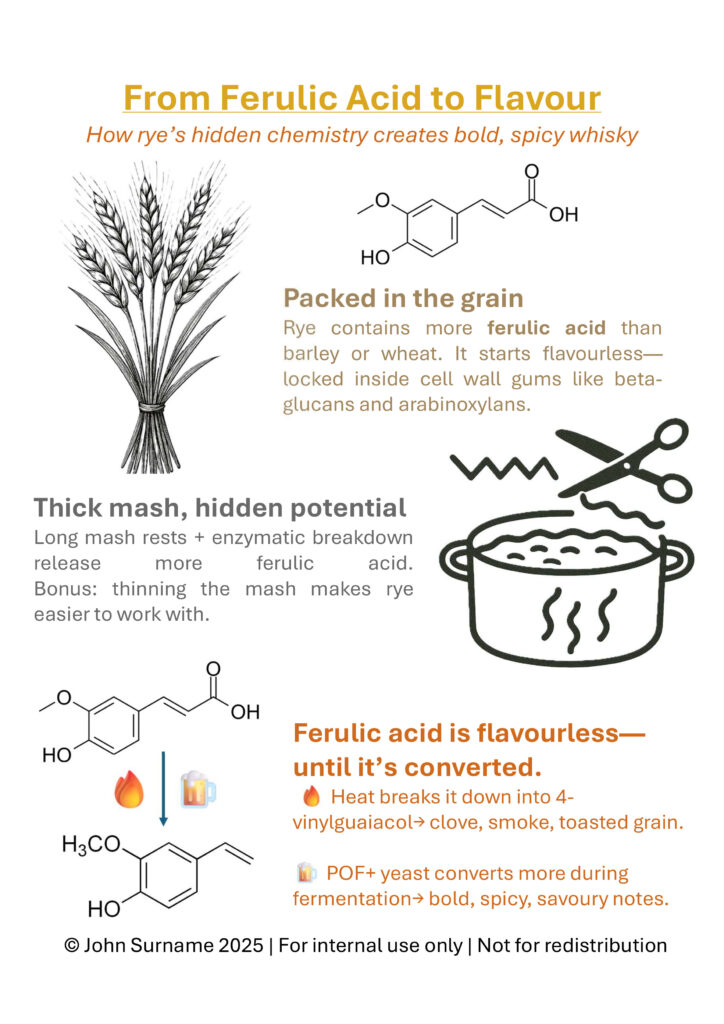

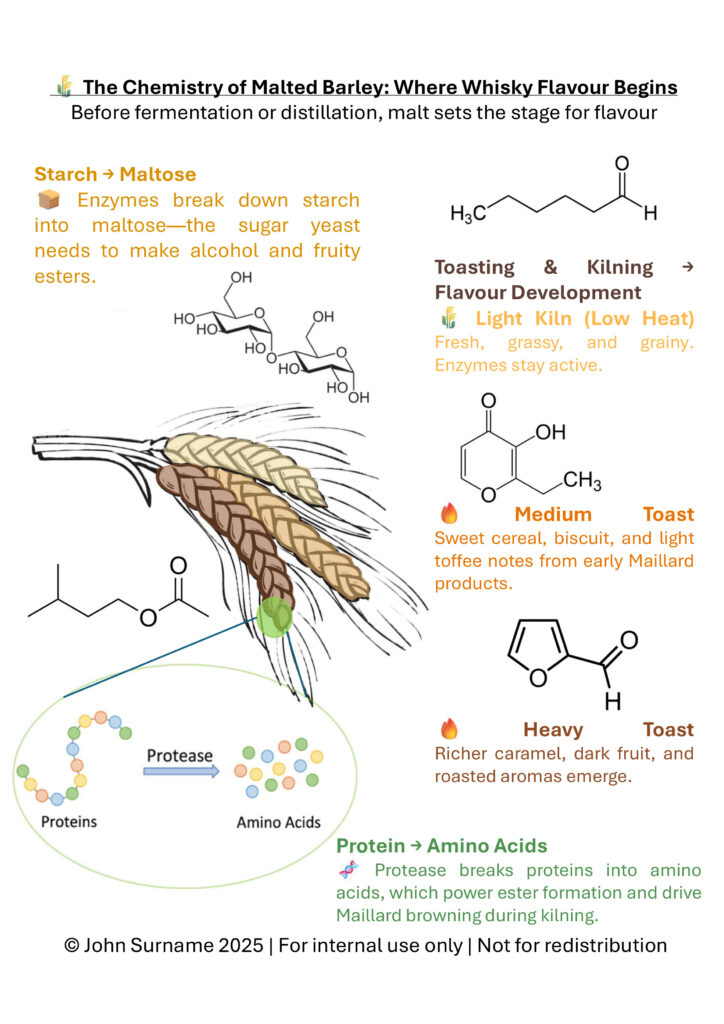

🌾 Grain Chemistry

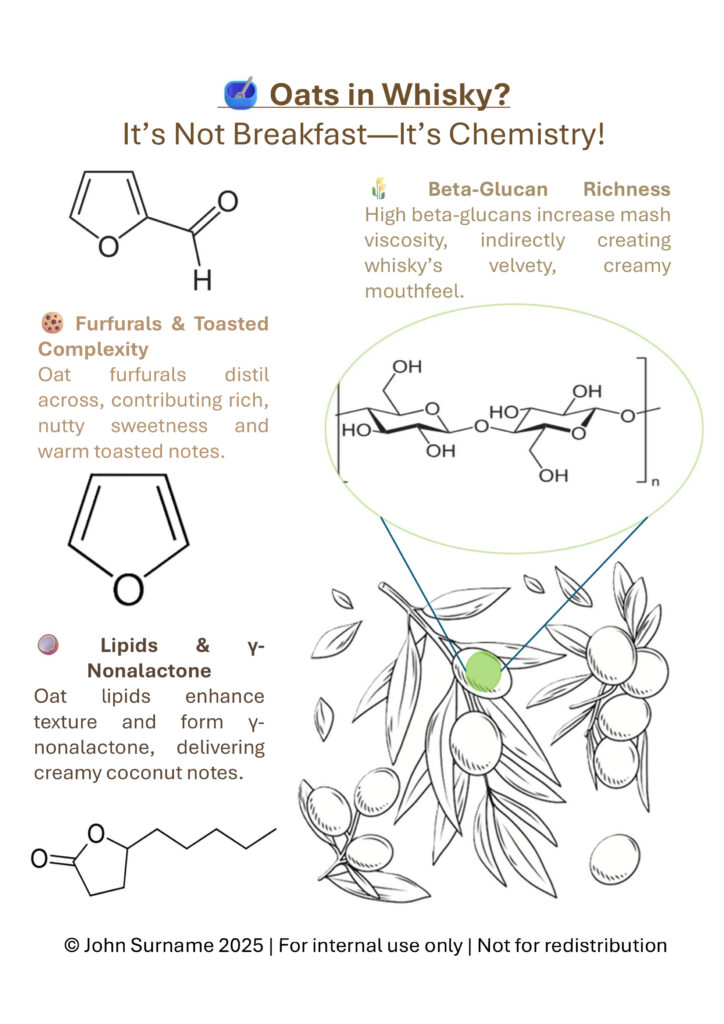

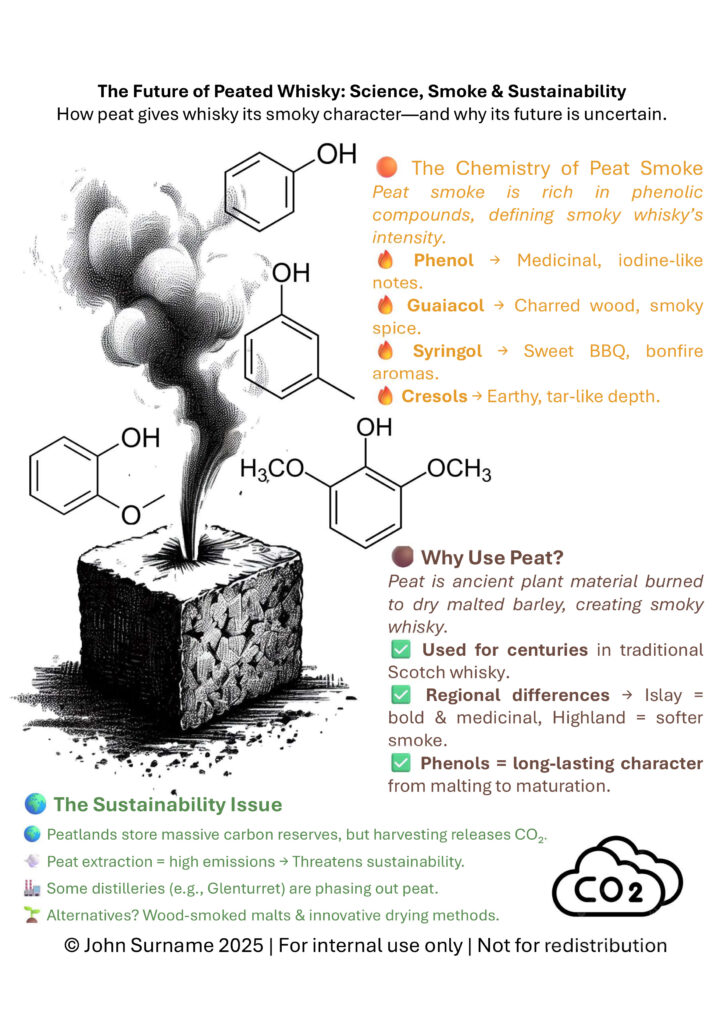

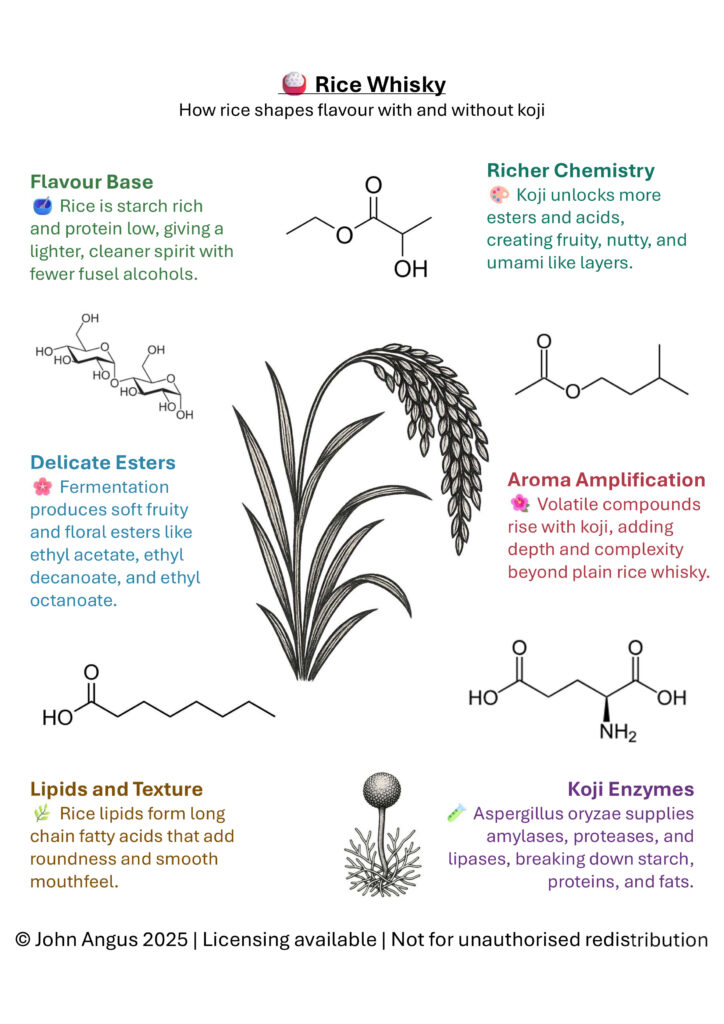

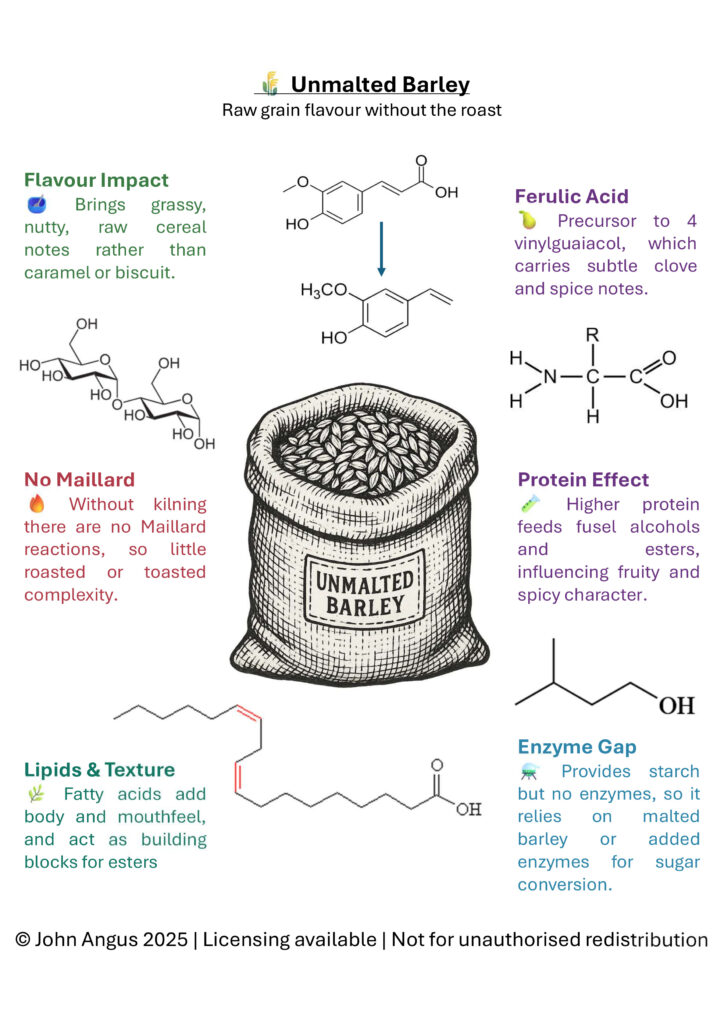

Grain is more than a source of sugar. It sets the foundation for everything that follows. Barley brings enzymes and malt sweetness. Corn adds smoothness and gentle fruit. Rye delivers spice through ferulic acid and phenol formation. Oats bring lipids and beta glucans that change texture and mouthfeel.

In this series I looked at how starch, protein and lipid composition influence fermentation and distillation outcomes. Choosing the right grain is as much about chemistry as tradition.

Check back next month for the continuation of this series!

By Gerald Dlubala

As growers try to regain the balance of supply and demand that was upended during the pandemic, some brewers are seeing hops as a marketing tool for more educated consumers. Is it time for hops to step forward and take a lead in craft brew marketing?

Civil Life Brewing, St. Louis, Missouri

“I think it is,” says Dylan Mosley, Head Brewer of Civil Life Brewing in St. Louis, Missouri. “As a brewer, the world of hops is becoming increasingly interesting, even for those who use traditional, established varietals. Cascade Hops are synonymous with North American Brewing, and we use them in our historical-type beers. But the delivery method of adding hops has progressed, and that’s pretty cool. We use different delivery methods depending on the layer and level of aroma and flavors we’re after. For example, in our Merchant Ship IPA, we mostly use our bell hops in pelletized form. Some of the other hops are processed differently and isolated from the plant in methods like CO2 extraction or through hop oils.”

Mosely says that brewers are increasingly able to get out of the hop whatever they are after by fine-tuning delivery methods and timing during production.

“From a brewery perspective, it’s all about control,” said Mosely. “Deployment is key with hops, and it’s fascinating to pick and choose how, when, and where to add them into the brewing process. The newer packaging and delivery methods are really fascinating to me. And as a brewer, I love their shelf life, storability, and variability of what part of the hop you use. The only thing a brewer should remain aware of is their filtration methods and how some of these different hop choices will react with their filtration pads or membranes.”

“It’s important to know that a little goes a long way with respect to replacing pellets with oils,” said Mosely. “But the more oils you use to replace traditional pellets, the more educated you have to be with deploying those oils. Education is key. It’s like a baker who uses exotic spices and clarified ingredients. A little can go a long way, and they must be used at the right times in the right amounts, or the layers of flavor will go haywire and become too pronounced or too specific. Drinkability can be reduced due to flavor profiles changing too rapidly. But having these types of contemporary hop products at our disposal is cool. It gives smaller breweries like us access to the same technologies and flavor profiles as the bigger breweries.”

Mosely attributes the excitement over hops to consumers becoming more educated about what is in their glass or can.

“I’m seeing some exciting things happening around hop use and choice, and the customers are driving those trends,” said Mosely. “So much so that I think we can expect more dramatic packaging highlighting the hops used in a specific beer. It’s something new for the consumer to learn and remember when they try new beers. If a beer shows the same hops or blend as something they’ve liked before, they’re more likely to try it. You know, wine drinkers look for wines from the same region or grape varietal, and I think you’ll see that with hop selection and marketing. Hops are an ingredient that the consumer can see, taste, learn about, and remember. More education about hops leads to excitement and conversation.”

Mosely said that there is far more disinformation than factual information when it comes to craft brewing. Consumers are ready to learn about the process and talk about it, and brewers can make hops more exciting by labeling what hops are in the beer in their hand. A few years back, it was huge to see the Mosaic or Amarillo terms thrown around, but now, hop-centric beers have their hops listed on the label to push that fact.

“It’s like music albums with guest artists labeled on the cover,” said Mosely. “It’s an added name recognition boost. If you’re at the grocery store and one beer label does not mention hops, but the same style of beer from another brewery mentions the included hop varietals, that’s the one that will usually get chosen. Brewing looks so daunting and mysterious due to all the equipment, but it’s still only four ingredients. You drink it, and sometimes you don’t realize that it’s the hops you’re tasting over the other elements of the beer. If you at least have the name of the hop in front of you, you now have a mental record of that with the flavor profile. It’s your personal beer database of your likes and dislikes, and that’s pretty cool. We’re telling a story every time we put a can on the shelf or a glass of beer in front of a patron, and sometimes that story is just the name of the hops.”

Glacier Hops Ranch

Montana-based Glacier Hops Ranch is a worldwide broker and dealer of premium processed hops sourced directly from hop growers and warehouses across the globe. President and CEO Tom Britz spoke with Beverage Master Magazine regarding hop trends in four primary areas of the industry.

1. Economic Efficiency: “Traditionally, craft brewers just wanted to make great tasting beer, no matter the cost, and that included the hops,” said Britz. “That’s not so prevalent anymore. Cost containment and economic efficiency drive hop choices in both the varietals used and how they are used and delivered. Brewers want to squeeze the most revenue available out of every batch of beer produced. Pellets have become the go-to choice in hop delivery, but as any craft brewer will tell you, pellets also soak up product, which adds up over time. We commonly talk with brewers who lose 10- 25% of their product through simple pellet biomass and waste. Hops start with 75-80% moisture at harvest in the field and are dried down to 7-8% moisture content. By substituting half of the pellets with products like our Hopzoil®, brewers can gain up to 7 ½ % yield per batch brewed. Over 12 months, that equates to serious revenue gains without sacrificing flavor or aroma. We have an interactive worksheet that uses hard costs to estimate each brewer’s increased revenue per batch. Even small craft brewers can see their expected increased revenue by plugging in their numbers and getting their results in black and white.”

2. Beverage Diversification: Many breweries use various vessels, packaging lines, and means of distribution, so they’ve got what they need to produce and package different beverages,” said Britz. “We see business models moving breweries away from having beer as their singular product, and the same goes for hop usage. Hops aren’t only for beer anymore. Hopwater is a popular, refreshing, best seller with low cost of goods and high margins, and easy to produce in one day with Hopzoil®. We see it made with the addition of citric acid and simple sugars, but increasingly we see it produced using our Hopzoil® as the only ingredient. It can be made in small batches, making it easy to move from flavor to flavor. Hopzoil® comes in 22 different varieties and blends. Consumers notice that hop water made only with Hopzoil® reflects only the hop flavor and aroma with no bittering, biomass, or waste. Places looking for a great NA alternative are experiencing wider customer bases with Hopzoil® and hop waters. It’s a way to diversify into the NA world without much extra cost or waste. Additionally, we see the use of Hopzoil® in hard ciders, fruit purees, and other craft beverages.”

3. Functional Beverage Use: “This is a huge area of growth for the hops industry,” said Britz. “Nutraceuticals are different applications for sure, and easier for some breweries to get into than others. When the hop compounds, or terpenes, are analyzed, you can cross-reference that analysis with their proven health benefits. We do with our pure hop oil what the marijuana industry does when analyzing the health benefits of their products. Our products provide calming effects just like CBD products, but without the lethargy that marijuana can promote. We’re seeing a steady growth of functional beverages that could use hops for conditions including pain relief, anxiety and depression relief, antioxidant properties, brain health, anti-microbial properties, and skin health, all kinds of benefits.”

4. Return to Forward Contract Farming: “Since late 2021-2022, there’s been an oversupply of some of the more popular hops,” said Britz. “Hop demand was going up, and then COVID knocked the bottom out of the market, leaving a large oversupply with no market. That’s finally beginning to balance out now, and because of that, we see an increase in contract farming to head off shortages in specific varietals. In the late 90s, up to 96% of hop farming was contracted. By 2020-2021, that number fell to mid 40% because of the excess in hops stored and readily available at discounted prices. So, from 2022 through 2024, 31% of acreage was pulled from hop farming due to these inventory excesses and increased production efficiency. After three painful years for hop growers, the supply and demand are starting to balance out. Contract farming ensures a predictable supply for all sides, but some smaller breweries may come up short or have difficulty finding what they need. The prediction is that for the 2026 harvest, forward contract farming will make a comeback, with those who did not get what they wanted this year leading the way to ensure their supply chain.”

Hop Favorites Remain Traditional While Delivery Method Evolves

“The main hop trends we still see are the classics, like cascade, chinook, and centennial, or a blend using those three,” said Britz. “We also have demand for our citrusy and juicy fruit bomb series. No matter what a brewer uses, we recommend starting with 50% pellet replacement using Hopzoil®. One hundred percent will give a different flavor profile. Hopzoil® requires no refrigeration or freezing. It’s water-soluble, so it gets shaken into an emulsion. A 12-inch cube of Hopzoil® can go on a shelf and free up two pallets worth of shelving or floor space. As with most ingredients, we recommend keeping it away from excess light, heat, and oxygen. Our packaging is topped off with beverage-grade nitrogen and can be topped off with nitrogen or CO2 for resealing. When using Hopzoil®, brewers don’t get that drop off in some IPAs where the flavor is there and suddenly it’s gone. We’ve also gotten calls from brewers who have used our oils to rescue a batch of beer that didn’t turn out as intended, whether for sensory applications or something else. That’s a cool option and something for brewers to keep in their pocket should they need to rescue a batch of beer.”

Britz says they have exported to over 50 countries and were awarded SBA’s Small Business Exporter of the Year in 2022.

“Quite a few breweries have won prestigious awards using our products,” said Britz. “Hopzoil® is made from wet hops directly out of the field in a steam distillation environment, capturing the volatile oils released into the atmosphere through traditional field drying techniques. This method makes our product 8-15 times more concentrated than other suppliers, and brewers describe our product as more intense and brighter.”

Advice For Craft Breweries

“I’ve seen a change over the last few years,” said Britz. “My advice for craft breweries is to focus on the service they deliver over the actual product they make, because the service will keep customers coming back as product trends and consumer desires change. Craft brewers are not in the beer industry as much as they are in the beverage industry. Recognizing the industry you are in allows much more creativity and out-of-the-box thinking.”

By Alyssa L. Ochs

In today’s competitive craft beverage market, packaging involves much more than just putting your beer or spirits into a functional container. Packaging makes a powerful statement about your brand’s story, values and commitment to the planet.

Modern craft beverage enthusiasts are drawn to products that evoke an emotional response and that stand out among the crowd in unique ways. Consumers have also become increasingly interested in supporting brands’ sustainability endeavors centered on recyclable and biodegradable materials in a circular economy.

To learn more about current trends in craft beverage packaging, Beverage Master Magazine connected with NEENAH, a world-class manufacturer of premium printing, packaging, label and specialty papers.

Packaging & Consumer Perceptions

Jennifer Dietz, NEENAH’s Label & Folding Board senior product manager, explained to Beverage Master Magazine how label design can be a powerful tool in shaping consumer perception. Headquartered near Atlanta, Georgia and with multiple U.S.-based manufacturing facilities, NEENAH’s offerings include label, box wrap, folding board and more. The company focuses on elevating brands through specialty and custom packaging substrates that demonstrate their uniqueness and communicate their brand ethos.

“Color and texture can instantly communicate brand values such as authenticity, luxury, sustainability or innovation,” Dietz said. “Uncoated labels, for example, offer a tactile, natural feel that conveys uniqueness and craft, helping products stand out from mass-produced alternatives.”

“Since most labels are a shade of white, introducing color or texture can dramatically enhance shelf appeal,” she continued. “NEENAH Label Papers can be manufactured in a variety of colors and textures, while offering consistent quality across production runs, ensuring brand integrity is maintained from run to run.”

Dietz also explained how secondary packaging plays a significant role in elevating brand presence.

“For spirits and premium beverages, a well-designed box can create strong shelf impact, signal quality and make the product instantly giftable,” she said. “Uncoated papers in rich, deep tones, can evoke sophistication and intrigue while offering a premium end-product with no white edges. NEENAH® Folding Board offers a collection of 13 in-stock colors, including boards made from 100% post-consumer waste and pearlized finishes, as well as other options.”

NEENAH’s Craft Beverage Label Options

NEENAH offers three label products, all of which are made to order and customizable.

Dietz said that NEENAH’s ESTATE Label® is the market-leading trusted brand for uncoated wet-strength labels. It is most often used for wine and is manufactured in 60-pound text weight. The standard offering includes an expansive selection of 11 colors and five distinctive finishes.

Secondly, there’s the BELLA® Label, which is a lighter-weight label but also manufactured with wet strength, with a 47-pound text weight. This label provides an authentic, hand-crafted look that is perfect for craft beverages.

Finally, NEENAH’s CLASSIC® Label is a premium label without wet strength, making it ideal for red wines, spirits and jar labels. This label offers a crisp, clean and elegantly uncoated solution for a variety of label and packaging needs.

Dietz elaborated on the concept of wet strength for labels and its importance for label stock. She said wet strength is a label’s ability to maintain its integrity and adhesion in moist environments such as refrigerators, coolers or ice buckets.

“It is a critical performance feature for products like beer and white wine, which are frequently exposed to condensation or submerged in ice,” Dietz said. “While wet strength doesn’t alter the visual appearance of the label, it plays a vital role in the manufacturing process. Specialized additives are used to ensure the label resists tearing, wrinkling, or detaching when wet, preserving both brand presentation and product durability.”

She also shared that NEENAH’s uncoated label stocks are engineered to perform just as well as the coated alternatives.

“NEENAH Label Papers offer exceptional dimensional stability, ensuring precise registration for intricate designs,” Dietz said. “Uncoated papers also excel with embellishments like foil stamping and embossing, which tend to pop more vividly against their uncoated surface. Additionally, they work seamlessly with die-cutting equipment, making them a versatile and reliable choice for high-impact label applications.”

Sustainability in Craft Beverage Packaging

Like many other brands serving the craft beverage market, NEENAH offers recycled and alternative fiber products to its customers as part of its focus on reducing its environmental footprint. Beyond just labels, there are various ways that breweries and distilleries can incorporate sustainability into their product packaging.

Craft beverage packaging must be sturdy enough to protect the products during transport and visually appealing on store shelves. However, there is also an industry push to address concerns around single-use items that require extensive resources to produce and often end up in landfills. Options like compostable six-pack rings and fiber-based carriers provide beverage producers with more choices beyond traditional plastic, allowing them to minimize pollution risks without compromising strength or aesthetics.

Planet-Friendly Packaging Options to Consider

There are biodegradable packaging materials available for the craft beverage industry, including plant-based plastics, molded pulp and compostable films. Beverage producers can also opt for packaging materials made from recycled materials to reduce their reliance on raw resources. Examples include aluminum cans with a high recycled content, recycled glass bottles and corrugated cardboard carriers.

In addition to choosing packaging materials made from recycled materials, you can take your commitment one step further and prioritize packaging that can be recycled after use. Many municipal recycling systems accept aluminum cans, clear glass, paperboard cartons and certain types of plastic. It’s also helpful to label your beverage packaging with straightforward recycling instructions so that consumers instantly understand how to recycle it without confusion.

An emerging concept to grasp is the closed-loop recycling model, in which packaging is designed with a mindfulness of circularity. Refillable glass programs and returnable aluminum growlers are examples of collection initiatives that keep packaging materials in continuous use, rather than discarding them. Technology is also aiding this effort with QR codes and smart labels that track the lifecycle of packages and add a sense of accountability and transparency to consumer exchanges.

Not only is eco-conscious packaging a practical and responsible choice, but it’s also a marketing opportunity. By advertising planet-friendly practices on your beverage labels and website, you share your sustainability values with the public. These subtle stories will resonate with many of today’s beer and spirit connoisseurs, helping them to connect with your brand on a deeper level.

Looking Ahead to the Future of Craft Beverage Packaging

This is an exciting time in a new era of craft beverage packaging innovation, particularly as technologies continue to improve and companies strike an optimal balance between functionality and environmental responsibility. Packaging has become a platform for brand storytelling and customer engagement. Meanwhile, researchers have been exploring the potential of next-generation biodegradable materials that leave behind little or no waste.

There are also specific design trends emerging in the craft beverage packaging industry, such as minimalist labels, lightweight bottles and reduced ink usage. These shifts represent further movement toward eco-friendly packaging choices and connecting with consumers who would like their purchases to align with their personal values.

Meanwhile, we expect that some policy and regulatory changes will influence craft beverage packaging in the years ahead. Some state and federal governments have already introduced or are considering stricter requirements on single-use plastics. As a result, craft beverage producers may face heightened obligations and responsibilities to reduce their landfill waste, while also being incentivized to use recycled materials during production. By anticipating and adapting to these regulatory changes early on, beverage makers can avoid compliance headaches and position themselves as industry leaders in an increasingly competitive and mindful marketplace.

If your beverage brand is looking for more from your packaging than just safely transporting products from one place to another, innovative companies like NEENAH can help. Your packaging choices will undoubtedly influence your customers’ perception of your brand and help people understand why making beverages is your passion. Crafting a delicious beverage is just part of the story, as packaging it in a memorable and responsible way ensures that your company will have a positive and lasting impact.

By Ethan E. Litwin

Since the 1980s, the U.S. craft beverage industry has expanded dramatically. Breweries grew from fewer than 100 in the early 1980s to nearly 10,000 today. The U.S. spirits industry shows a similar trajectory, rising from under 100 licensed distilleries in the 1980s to over 3,000 today. The U.S. wine industry experienced earlier momentum after the 1976 “Judgment of Paris,” yet still only had about 2,500 vineyards by the early 1980s. That number has since grown to nearly 12,000.

Despite this remarkable expansion, most craft producers remain small. Craft brewers typically produce under 7,500 barrels annually, while craft distilleries typically produce fewer than 250,000 proof gallons per year. These small producers face competition from dominant incumbents: two brewers control about 65% of the market, with output exceeding 6 million barrels each, while large distilleries produce more than 8 million proof gallons annually. U.S. vintners also generally remain small, producing fewer than 60,000 wine gallons annually, while their largest competitors produce more than 15 million wine gallons.

One of the most consistent challenges for small-scale producers has been distribution and market access. Simply put, making a high-quality beer, wine, or spirit is only half the battle—getting it into the hands of consumers via restaurants, bars, or retail shelves is often far more difficult. This article outlines some of the major challenges faced by small producers and suggests some avenues on how the system may be changed, or challenged.

Regulatory Barriers to Competition

The Legacy of Prohibition: The largest obstacle for small producers is the U.S. alcohol distribution system itself. After Prohibition ended in 1933, most states adopted a “three-tier system,” which separates producers (tier one), distributors/wholesalers (tier two), and retailers (tier three). Under this structure, producers are generally prohibited from selling directly to retailers or consumers, except under limited circumstances such as on-site taprooms, tasting rooms, or, more recently, direct-to-consumer shipments in some states.

The three-tier system artificially enhances distributors’ importance—distributors often control key customer relationships, point-of-sale marketing, and product placement decisions. The architects of the three-tier system envisioned a competitive marketplace where distributors would compete for producers’ business on the price, scope and quality of their services. State franchise laws, however, significantly restrain that competition by restricting the ability of producers (generally brewers, but often in other sectors as well) to switch distributors without proving “good cause,” a dauntingly expensive and time-consuming endeavor. These laws inevitably created a misalignment of incentives, reducing distributors’ investment in marketing new or smaller brands—the very craft producers who generally lack the ability to terminate their distributors for cause.

Most states also impose price controls on distributors in the form of “post-and-hold” rules, which require distributors to “post” their prices with state authorities and then “hold” those prices constant for a period of time. During the hold period (typically 30-60 days), producers are prohibited from engaging in any form of price competition. Some states all for limited “meet-but-not-beat” competition, which allows for price-matching, but continues to prohibit distributors from undercutting rivals’ prices. Although most states do not directly control prices set by distributors, some states have adopted uniform pricing rules, prohibiting distributors engaging in price discrimination downstream by charging different prices for the same product to different retail outlets.

While these rules are clearly anti-consumer in effect and in intent. Prohibition may have ended in 1933, but concerns about alcohol remained and states actively sought to manipulate market prices to discourage the consumption of alcohol. It is hard to think of another American industry where regulations are specifically designed to restrain price competition and increase consumer costs.

Antitrust Enforcement Failures

The Problems Caused By Distributor Consolidation:

Ironically, the three-tier system was intended to prevent market foreclosure by a dominant, vertically integrated producer, while state franchise laws were intended to protect distributors from the whims of powerful producers. But as the distribution sector has consolidated, the few remaining distributors have tended to prioritize brands with high volume, national recognition, and strong marketing budgets. A small craft brewery or distillery will struggle to get attention from distributors compared to giants like Anheuser-Busch (ABI) or Diageo.

Another barrier is the consolidation of the wholesale industry. Over the past several decades, wine and spirits distribution has become dominated by Southern Glazer, which operates in 44 states, and Republic National Distributing Company (RNDC), which operates in 35 states. The next largest competitor, Breakthru Beverage, operates in only 13 states. Southern Glazer and RNDC command national networks and wield enormous leverage with retailers. The situation is no better in the beer segment, where independent distributors are typically affiliated with either ABI or Molson Coors. ABI, however, is now vertically integrated in many key states and its wholly-owned distributors do not carry third-party brands other than a handful of very small local brands. Accordingly, in markets where ABI’s wholly-owned distributor is present, craft brewers are forced to deal with a monopolist—the independent affiliated with Molson Coors—to gain market access, with predicable results.

For small producers, signing with a distributor is often seen as a milestone—but in practice, many end up buried in vast portfolios. A small distillery’s gin may compete for the same distributor’s attention against dozens of other gins, including global brands with multimillion-dollar marketing budgets. Without aggressive representation, small brands get little visibility, and sales stagnate.

Competition for Shelf and Tap Space

Even if a distributor agrees to carry a small producer’s product, there remains the issue of limited space at the retail or restaurant level. Supermarkets and liquor stores typically allocate shelf space to brands with strong consumer demand or to those offering better promotional support. Large producers can incentivize retailers with discounts, rebates, and marketing dollars, effectively buying visibility. Small producers rarely have the financial muscle to compete. Without marketing support, distributors and retailers often deprioritize smaller brands. Even when products make it onto shelves, they may sit unnoticed among hundreds of competing SKUs. Shelf placement matters enormously—a small brewery’s seasonal IPA stuck on the bottom row may never be seen by casual shoppers. For restaurants and bars, education is key. Servers and bartenders are more likely to recommend a product they know. Yet small producers often lack the resources to run training programs, provide free samples, or sponsor events at scale.

Similarly, bars and restaurants often have limited tap handles, wine lists, or cocktail menus. A bar might have 20 taps, but a distributor may push them to feature a national brand lager and IPA, squeezing out smaller craft options. Wineries face the same issue with wine lists: Many restaurants lean toward recognizable labels that reassure consumers, leaving little room for lesser-known vineyards.

Consolidation in Adjacent Markets Threatens the Viability of Craft Producers

Distribution challenges are compounded by the financial realities of small production. Craft breweries, distilleries, and vineyards typically operate with slim margins. The costs of raw materials, labor, equipment, compliance, and packaging leave little room for the kinds of marketing and promotional spending that larger competitors deploy.

For example, the cost of aluminum beverage cans has risen sharply in recent years due to a combination of industry consolidation and trade policy. The aluminum can market has become increasingly concentrated, with just three suppliers—Ball, Crown Holdings, and Ardagh— controlling more than 80% of U.S. can production. On the raw material side, a similar pattern has emerged: Only a handful of rolling mills, led by Novelis and Constellium, dominate domestic aluminum sheet supply. In these highly concentrated markets, buyers have limited ability to negotiate price as demand for cans has surged and supply bottlenecks have emerged. At the same time, the Section 232 tariffs first imposed in 2018 added a 10% surcharge on imported aluminum, effectively lifting domestic prices as well since U.S. producers peg contracts to tariff-inclusive benchmarks. This year, the situation has become worse as tariffs have progressively increased and currently stand at 50%. Together, these dynamics have pushed can costs up by double digits over the past five years, making packaging one of the fastest-growing expenses for brewers, distillers, and vintners. While large producers with established brand presence can pass on these costs to consumers, smaller producers seeking to gain traction in a crowded marketplace may be forced to absorb a greater percentage of these costs.

Solutions

There is no single solution to the competitive problems in the beverage industry. First, wholesale changes to the regulatory structure governing the distribution of alcoholic beverages. In addition to permitting self-distribution and direct-to-retail sales, the rules governing distribution should be amended to prohibit the sort of exclusive contracts that tie retailers and bars to dominant brands. Pay to play schemes, such as tap handle exclusivity and shelf space payments should be broadly prohibited. Direct to consumer sales, widely practiced in the wine industry, should be expanded to include craft beer and spirits along the lines of recent legislative initiatives adopted in New York and elsewhere. A federal law enshrining direct of retail and direct to consumer sales would also reduce the compliance headaches created by differing regulations at the state level.

Regulatory reform, however, may not prove to be sufficient to create a truly competitive marketplace where craft producers can flourish. Even without changes to regulations, anticompetitive practices can be challenged under the antitrust laws by federal and state enforcers, as well as by private companies acting alone or as part of a class action. There are several potential grounds for antitrust enforcement. Exclusive dealing contracts that favor large producers over craft competitors (e.g., denying such producers access to shelf space, taps, or distribution) can be challenged as an illegal market foreclosure. To the extent that large producers and distributors have entered into agreements that result in the exclusion of craft competitors at the distribution or retail levels, those agreements can be challenged as illegal group boycotts. Tap handle exclusivity, shelf space payments and other pay to play schemes can similarly be challenged under the antitrust laws without any further changes to regulations. Even corporate transactions, such as the acquisition of leading craft producers by large established producers, can be challenged under the antitrust laws if the effect of those acquisitions will be to substantially foreclose distribution channels for competing craft producers, forcing them to use smaller, less efficient distributors who are typically unable to secure comparable placement at retail stores—all while increasing the costs of such distribution. Finally, antitrust enforcement in packaging and logistics markets can also help to reduce costs that are disproportionately borne by craft producers.

These issues are not hypothetical. Following its investigation, the Federal Trade Commission, which typically takes the lead on antitrust issues affecting the spirits industry, sued Southern Glazer at the end of last year for price discrimination, alleging that the distributor was offering preferential discounts to large chains making competition from small independent retailers more difficult. For its part, the Department of Justice, has uncovered evidence that large brewers use a combination of anticompetitive practices to obtain exclusive distribution, which inhibits the ability of craft brewers to expand sales. These efforts are important, but more work must be done in order to level the playing field for craft producers.

Conclusion

Marc Farrell, the founder and CEO of Ten to One Rum, is one of the lucky ones. Through a combination of passion and business savvy, his brand is breaking through in a meaningful way. But Marc increasingly feels like it is becoming impossible for new brands to get to market. The system, he notes, is set up to favor large incumbents. “The U.S.,” Marc observes, “is the most forward thinking business environment in the world. But spirits is an outlier.” Beholden to antiquated regulations and largely denied direct access to retail customers and consumers, craft brands are “flying blind.” If this remarkably innovative industry is to survive long-term, systemic change is needed.

By Raj Tulshan, Founder & Managing Partner, Loan Mantra

In today’s economy it might seem like the best action is to remain still. To take little or no financial action at all. But this can be detrimental to your business. Even though inflation and interest rates are high, there are still smart financial moves that your beverage business can make now for continued success.

Interestingly, a Harvard Business Review article studied the specific actions of companies during recessionary periods.1 They measured the specific actions companies made during this time and the outcomes. It was found that a certain combination of decisions that company leaders made during this time made them more profitable coming out of and after the recession. The article states, “These companies acted progressively by deploying the right defensive and offensive moves to reduce costs selectively by focusing more on operational efficiency than their rivals do, even as they invested relatively comprehensively in the future by spending on marketing, R&D and new assets.” It is also interesting to note that successful companies cut operational waste versus people.

With these factors in mind, here are some financial moves to consider:

Capital Forecasting & Expenditures

Now is the time to forecast capital, credit and cash flow needed for the next 18 months. Consider new product development, seasonal and holiday spikes and shore up any money you will need. Consider USDA Value-Added Producer Grants (VAPG) for breweries/distilleries and state-level agribusiness/craft beverage incentives.2 Lock in long-term financing now while money and loans are readily available. Fintech platforms like those at loanmantra.com allow you to compare multiple lenders and access capital faster.

If you need new equipment the tax incentive, or bonus depreciation rate, is better this year than in 2026. In 2026, the rate is set to decrease to 20%, before being eliminated in 2027. If you plan to make large capital expenditures, consider accelerating them to take advantage of the more favorable depreciation schedule.

Partnerships & Growth

With many businesses struggling, establishing a partnership or acquiring another company might makes sense. As companies are forced to close, their customers will be looking for alternatives. Surprisingly, now is a great time to buy commercial real estate. Commercial real estate values are shifting where some markets are offering bargains for businesses ready to buy or lease. There may be less competition for prime locations. Less buyers also means that you have more negotiating power. And although interest rates can go down, you can always refinance the property.

Consumer Trends & Experiential Marketing

Identify which of the most current consumer trends apply to your customer base and market based on that. According to current reports, what appeals to consumers is community-based localism and having a unique experience with a brand. An example of promoting this could be a campaign like, “Drink Local, Support Local Farms.” Or tell a farm-to-glass story that resonates with inflation-weary but community-focused buyers. Taprooms, tasting rooms, tours and events provide higher margins than wholesale. Use digital tools to build brand engagement like TikTok Reels to showcase behind the scenes brewing, mixing and bottling. Encourage User generated content of customers drinking your brand with a hashtag that you share on social media channels.

Operations & Expense Management

Secure contracts for supply and pricing of ingredients early: hops, malt, fruit, glass can be volatile. Partner locally when and if possible. Aluminum can shortages are easing—explore canning over glass where margins allow. Eco-friendly packaging wins grants + consumer loyalty. Use part-time/seasonal labor during peak events. Upskill staff to cover multiple roles (bartender + tour guide).

Sales & Distribution

New distribution channels are only limited by your imagination. Test the places you think would be ideal for your products’ expansion. Here are some places to start: retailers, grocery stores, specialty shops, farmers markets, events management firms and catering companies. Another alternative is providing a beer truck for hire, keg with delivery (keg on legs) or other creative service. It’s about creating additional revenue streams. And as some states allow direct to consumer (DTC) sales, more opportunities arise.3 Beer of the month and subscription boxes offer consistent sources of income coming in.

Tech & Innovation

Look at the ways other industries are using AI and Data and learn from the good examples. For example, many businesses use AI for sales forecasting and seasonal product planning. Also look at different resources that are used by other craft brewers like: WriteCream Label Writer, BrewFather and BrewTarget, if you haven’t already explored these. And think outside the box. Many restaurants use QR codes for menus but how about using digital tip jars to streamline the taproom

experience? Or using customer relationship management systems to segment tasting room customers for targeted offers? And many brewers use sustainable business practices in the manufacturing process. Have you considered looking at grants that might apply to green technology that saves water, and energy?

Navigating the financial landscape of 2025 requires strategic planning and a keen eye on both current trends and future opportunities. For your beverage business, this means actively engaging in capital forecasting, taking advantage of tax incentives and exploring partnerships that can drive growth. By focusing on consumer trends, such as the demand for local and unique experiences and optimizing operations with eco-friendly practices, you can position your business for success despite economic challenges.

Leveraging new sales and distribution channels, including direct-to-consumer options and embracing tech and innovation can open additional revenue streams and improve efficiency. As you implement Remember that the key to thriving in a fluctuating economy is adaptability and a proactive approach to seizing opportunities as they arise.

By considering these financial moves, your beverage business can not only weather the economic uncertainties of 2025 but also emerge stronger and more competitive in the market. To contact the author, visit loanmantra.com or connect at https://www.linkedin.com/in/tulshan/

By Hanifa Sekandi

Autumn represents a season of renewal and rest. A time when people are ready to slow down after the summer rush of vacations and outdoor sun activities. Many households are a lot quieter with the return to school. So, of course, beverage marketing must pivot. ‘Tis the season for a fall branding upgrade! There are many directions that a brand can go during the fall. There is also more than one opportunity to capture your audience’s attention, unlike summer. Yes, summer beverage marketing is fun, but it does not provide as many opportunities to appeal to different consumers as fall does. Some may disagree because summer fun is full of outdoor adventures, festivals, and barbecues where the drinks flow endlessly. But, beyond the typical summer beverage themes, what else is there?

As we dive into fall marketing upgrade strategies, it is apparent why fall is a noteworthy contender for beverage sales in October and November. Basically, do not count this time of year out. Do not limit your beverage marketing budget to July, August, and December. Understandably, these months are quite favorable for beverage sales. In beverage marketing, it is important to play the long game, so every month counts. A great example of fall beverage marketing that has taken over fall is the pumpkin-spiced latte.

When Peter Dukes, a product manager at Starbucks, pitched the idea of a pumpkin-flavored beverage inspired by the essence of autumn and the dessert associated with it, pumpkin pie. He unboxed a fall marketing and cultural phenomenon. Opportunities in marketing always present themselves; it is up to brands to be bold and seize them. Your consumer already shows you what they desire; it is up to you to read their cues and deliver. Great marketing is wrapped in nostalgia. People love comfort and familiarity. The pumpkin-spiced latte reminds people of Granny’s pumpkin pie, topped with whipped cream, a treat enjoyed in the fall and the winter months. So, let’s upgrade!

Thematic Upgrades

Sometimes your brand needs a theme. Start brainstorming themes that are synonymous with the fall. Think of every possible symbol or activity that comes to mind when you think of this time of year. Delve deep into your childhood memory bank. What good fall memories do you cherish? How does it make you feel? The goal is to evoke an emotional connection to your fall marketing campaign. It is about creating something familiar, more so than something outrageous or bold, as you did for summer campaigns. The summer is about a lot of noise, more action. The fall is about comfort and slowing down. Is your cider a warm, cozy beverage? What is your beverage best paired with? An apple pie-flavored cider would be a hit beverage. For those who love apple picking, warm apple pie, or warm apple cider, once the leaves develop an orange and golden hue, this would be a go-to beverage. You could create a thematic campaign, “all things apples,” that includes activities and recipes.

When you craft your campaign around a theme, it allows you to create a story. A story that supports all your marketing verticals. This includes hosting experiential events to support your theme. Maybe you can partner with an orchard for a brand takeover. At this event, you can serve both alcoholic and non-alcoholic ciders. Beverage bands in the RTD non-alcoholic space should absolutely take advantage of this opportunity. An event that will include fall activities like apple picking, a storefront to purchase apple pie or crumble, and merchandise that complements your theme. Some apple orchards also have a farmers’ market on site, a great way to showcase your beverage by giving samples, and where patrons can purchase it. According to the Apple Association, there are approximately 600 orchards in New York. This is just one state! An outside-the-box idea, but a timely seasonal campaign.

This theme can also shift to pumpkin patches and hayrides. A theme that also extends to Halloween. The use of pumpkin is already popular; it will be easy to entice pumpkin-spiced latte enthusiasts. You can target three different consumer groups with an apple-themed marketing campaign, a pumpkin campaign, or a Halloween campaign all at once.

Ambient Upgrades

Sometimes it is all about a vibe. Think of this strategy the way an interior designer views upgrading a room in someone’s home. Or better yet, your consumer who most likely loves to shop for seasonal fall decor. How can your beverage complement their ambient upgrades, elevate their space, and add to the fall atmosphere they would like to create in their home or at a gathering? Is this a beverage that can be displayed on their table next to a delicious charcuterie board? When people walk into the store, does your beverage send cues to the buyer? Is it autumn?

Packaging adorned with fall colors or imagery and symbols will metaphorically speak to this consumer. Sometimes, it is an unconscious symbolic cue that draws people to beverages packaged for the season. It is due to familiarity. What matches their fall decor, what would add to the moment, or enhance the experience? If they are going for cozy fall vibes, when they spot a product, even a beverage that is associated with this, it will incline people to purchase it. It is the same feeling that is evoked when people buy an apple or pumpkin-flavored coffee from the grocery store, and cookies they will store in a jar with fall artwork etched on it, purchased from a home decor store.

Keep in mind, the product still matters. Your beverage should taste good. Quality ingredients are still the star of the show. Hopefully, your fall beverage campaign performs well, and consumers look forward to it every fall like a pumpkin-spiced latte. Imagine being the RTD of the season or the cider that people must buy as soon as September 22nd hits?

Ambient upgrades allow you to elevate your packaging. It is a great time to be creative and add a little glitz or glamour to your branding.

Everything Upgrade

As mentioned earlier. Your fall marketing upgrade can be all things fall. Create a storyline for your marketing campaign. Starting with apples and then segwaying to pumpkin, a bit of Halloween, and even Thanksgiving. Dub this the “ultimate beverage fall story,” a chapter of the year where your brand takes people on a fall adventure. Full of all the things that people have come to love about this time of year. From packaging upgrades to social media and out-of-home campaigns, a story that can captivate the senses and invite beverage connoisseurs to join in and add your beverage to their personal fall story.

A call to action, asking your consumer what they love about the fall, is a great way to get engagement. Share your favourite fall moments with our beverage, a food, or a recipe that pairs well with it. An everything upgrade will keep things exciting and allow you to maintain the momentum you gain in the summer. It is also a great lead-up to winter marketing, a beautiful beverage story for your brand to write.

By Molly Cerreta Smith

Late last year, the National Restaurant Association (NRA) made its predictions for 2025’s top alcoholic beverage trends. They hit the nail on the head with “90s martinis,” particularly the espresso martini, which gained steam in 2024 and blew up in 2025, and also named hyper-local beer and wine, creative spritzes, flights, and innovative old fashioneds among its What’s Hot list for 2025.

Early on, the organization also predicted no- and low-alcohol options for cocktails, beers and wine, not as “non-alcoholic” choices but rather when presented with the option of “with or without alcohol.” By about mid-year, the NRA added watermelon flavor to its list of standouts for 2025, noting the introduction of London Liqueur Co.’s new watermelon liqueur, which was a highlight of the National Restaurant Association’s Show 2025 in May.

Dirty sodas and nostalgic/retro flavors for both soda and cocktails started to make their mark—with big soda brands bringing back classics and adding a variety of experiential flavors to their lineups. But now that fall and winter are on the horizon, what are consumers looking for when it comes to filling up their glass? Tait Ludwick, beverage director of Keeler Hospitality Group based in Arizona, shares some insight.

“Savory baking spices and bold, robust flavors are definitely at the forefront,” he says, adding, “I also believe Amari will play a leading role this season. Across the country, more bars are leaning into Amaro as a way to create that deep, comforting ‘winter in a glass’ experience.”

While keeping up with the trends and the seasons is a fun way to keep customers excited and engaged when it comes to the cocktail menu, some tried-and-true flavors are always a hit.

For example, Ludwick says, “I always return to a few favorites that define my style. Chocolate is at the top of that list—I wish I saw it featured more often on menus. Beyond that, I gravitate toward baking spices, brown sugar, delicate fruits and spice-driven notes.”

“This season, I’m especially excited to work with teas, particularly Asian varieties,” he says. “Their nutty, roasted qualities bring a unique depth that pairs beautifully with winter cocktails.” Asian flavors are definitely a hot trend for 2025 across the board in food and beverage. Many of the year’s popular cocktails have taken inspiration from boba tea. In addition, offering Asian teas on a beverage menu is an easy way to incorporate the aforementioned “alcoholic or non-alcoholic” option.

While lychee has been a popular option for decades and continues to be, other Asian flavors with bold and spicy notes add more complexity to fall and winter beverages—including yuzu, ginger and baijiu. Think earthy mushroom martinis, miso-infused margaritas and Japanese highballs. Rather than sweet, these trending flavors give cocktails a savory and spicy kick that aligns well with fall and winter and complements seasonal dishes.

When it comes to moving from summer cocktails to decidedly more fall and winter vibes, transitioning beverage menus is key to keeping customers engaged.

“For us, the transition feels very natural. After our first seasonal rollout, I noticed some guests still craving cocktails from the previous menu. That’s when I introduced Poppy’s Aces, a way to carry over favorites with a new seasonal twist,” says Ludwick. “We look closely at the styles our crowd gravitates toward and reinvent those with fresh, accessible flavors. For example, old fashioneds were extremely popular last year, so we transitioned into a Brown Butter Banana Old Fashioned. The rich, savory molasses notes balanced with fruity warmth gave guests that cozy, seasonal vibe, while still keeping the drink exciting and new.”

Rather than entirely replacing a summer menu with a fall one, some transitional options can ensure customers still get a familiar version of a favorite beverage, but with a slightly seasonal twist. Doing so in small doses also ensures customers don’t feel as though they are missing their favorite beverage from a previous season.

“We focus on developing our guests’ palates over time. We often begin with approachable flavors that appeal to snowbirds and casual drinkers, but each time they return, we introduce something new and slightly more adventurous,” Ludwick says. “It’s very much like telling a story—each visit reveals a new chapter, keeping guests curious and engaged.”

Naturally, curiosity is a great way to entice guests and introduce them to new and seasonal flavors. Another fun way to bring the fall and winter season to life through the cocktail menu is through themes. However, there are a few essential things to keep in mind, such as the location and overall theme of the establishment itself.

Ludwick weighs in: “I love the idea of themed menus, but I approach them with flexibility. In Arizona, we don’t get the same dramatic winter weather, so some classic ‘cold weather’ themes don’t always resonate. Instead of locking into a theme, I prefer to showcase standout cocktails for each holiday—something that feels like the biggest gift under the Christmas tree waiting just for you. When the focus is on delivering the best-tasting drinks rather than fitting a theme, you create a more memorable experience and avoid limiting creativity.”

Theme beverages tend to work well when aligned with a specific event, such as a pairing dinner with unique themed cocktails, for example. This is an excellent way to showcase the talent of both the kitchen and the bar staff, offer unique one-of-a-kind beverages, and gauge customers’ interest in these types of events, dishes and drinks for future experiences and menus.

And while following the trends and presenting themed beverages for a specific season, holiday or series, such as football, can be fun and innovative ways to bring customers back and appeal to different demographics, class and signature sips should never be counted out. These tried-and-true beverages should be the base of every establishment’s cocktail program and can be tailored to suit the theme of the establishment itself.

“Classics are non-negotiable—they are timeless, universally recognized and must be made true to form. When I see a Clover Club, an Old Fashioned or a Whiskey Sour, I know exactly what I should be served,” Ludwick says. “Signature cocktails, on the other hand, are about showcasing a bar’s identity. They’re the ‘house specials,’ crafted to reflect the restaurant’s unique personality. Both are essential: classics ground the menu in tradition, while signatures bring innovation and individuality.”

When developing fall and winter cocktail menus, keep variety, seasonal flavors, holidays, events and trends in mind. While these are keen ways to keep customers coming back for more, it’s also a fun way to boost sales and attract new customers.

In doing so, keeping true to the nature of the establishment while also offering a non-revolving menu of classic and signature beverages can ensure that customers who prefer the familiar will always feel welcome, regardless of the new sips of the season.

By Becky Garrison

When the Confederated Tribes of the Chehalis Reservation (also known as the “People of the Sands”) was established at the confluence of the Chehalis and Black Rivers in Southwest Washington in 1864, they were subject to the Indian Trade and Intercourse Act signed by President Andrew Jackson in 1834 that banned distilleries on tribal lands. After Chehalis tribal leaders selected their site on their property for their future distillery, designed the facility, and submitted plans to the Bureau of Indian Affairs (BIA) in Washington, D.C in 2017, they received word from the BIA that their plan was illegal. If they chose to continue with their plans to distill spirits on their lands, the BIA could level a $1,000 fine, as well as send agents to smash their stills Prohibition style.

At the tribe’s urging, their local member of Congress Rep. Jaime Herrera Beutler (R-WA) sponsored H.R.5317, a bill that repeals this 1834 law. After extensive lobbying by the Chehalis tribal leaders, this bill received bipartisan support from both houses of Congress. After this bill was passed in 2018, the Chehalis Tribe along with the other 573 Indian tribes legally recognized by the BIA of the United States could legally distill spirits on their land.

The name “Talking Cedar” profoundly reflects the tribe’s identity. The word “Talking” evokes the rich oral history of the Chehalis people, whereby their stories are passed down through the generations. Cedar trees have represented important symbols in the Northwest for generations. As each ring represents a year of growth, these trees tell the story of what they’ve seen and witnessed across the generations. Also, these trees provided the tribe with material for key daily items, as well as symbolizing the tribe’s connection to their environment.

According to Harry Pickernell Sr., Chehalis Enterprises’ Chief Operating Officer, they began with great partnerships that didn’t quite work out. “So, we learned how to do distilling and brewing along with getting a great team together,” he reflects. In his estimation, their patience and hard work paid off with rave reviews from their guests and awards for their products.

A State-of-the-Art Distillery & Brewery

Their 35,000-square-foot distillery, brewery, and restaurant is situated on the tribe’s 5,420-acre reservation. This space includes a15,000 sq. ft., state-of-the-art production facility located on the Chehalis Tribal Reservation. Their distillery featured 31,000+ liter fermentation tanks, custom Italian pot stills, a 25-ft continuous still that’s the largest west of the Mississippi, and 90-liter hillbilly stills with the capability to produce 10,000 barrels of whiskey per year and nearly 1.5 million gallons of other spirits. Also, they are home to a 60 BBL brewhouse, which gives them the capacity to produce nearly 1,860 gallons of beer in a single batch. This venture employs over 80 people including tribal members.

The brewery and distillery sit behind their farm-to-fork restaurant that includes two bars and a retail shop where their products are available for sale. Currently, their spirits are available for retail sale in Washington State, Oregon, and Idaho with their beers available in Washington State with plans to expand their distribution.

As part of their commitment to the land, their brewing and distilling processes start with pristine water from their artesian well with a water treatment facility on-site to minimize their environmental impact. In addition, they collaborate with local farmers in developing the best Pacific Northwest wheat, barley, and other grains for use in their beers and spirits. Also, they forage botanicals like fir tips and yarrow used in their gin on their property, as well as use 100% recycled glass for their gin bottles.

Helmed by Master Distiller and Head Brewer Ryan Myhre, formerly of Big Time Beer Company (Seattle, WA), Talking Cedar brews a range of beers such as their featured brew Chehalis Light, a classic American Light Lager. Other beers include a Raspberry Blonde, a Juicy IPA, a Pacific Northwest IPA, and a Pilsner. After mashing and fermenting, their spent grain is used by local farmers as cattle feed.

At their distillery, they produce over ten spirits including their award-winning Kayak gin, the first legally distilled spirit made on Native American land. This spirit made from mountain water and foraged botanicals captures the Pacific Northwest natural flavors with a bold blend of Douglas Fir and Juniper is tempered with Mountain Yarrow and Nootka Rose.

Their forthcoming vodka line will be called Tail Feather which will be produced with locally grown, sustainably produced, and sourced wheat from nearby Boisfort Valley. In Myhre’s estimation, as wheat vodka is not as neutral as corn vodka, it can be a bit challenge to make vodka using white. “After many trials and errors, we’ve found a way to produce a very high-quality wheat vodka on their column still,” he reflects.

Also, they produce a series of hand-crafted, small-batch flavored whiskeys. Cask-finished brandies, and other specialty spirits that are infused with natural ingredients. For example, their Freezer Jam is made with real berries, their Ginger Drop uses real ginger, honey, and lemon, their Sugar Sand is sweetened with natural maple syrup, and their Cabin Coffee contains real espresso and natural maple syrup.

Talking Cedar’s Whiskey Program

Under the direction of Matt Hofmann, co-founder of Westland Distillery and current General Manager of Talking Cedar, they launched a comprehensive whiskey program. During his 13-year tenure at Westland, Hoffmann played an instrumental role in the creation of the American Single Malt category, which was formalized by the TTB on December 18, 2024.

His accolades include being named Whisky Magazine Craft producer of the year, Forbes 30 under 30, Imbibe person to watch, and StarChefs Seattle Rising star. Also, the whiskeys he produced at Westland were awarded as one of the top twenty whiskeys in the world in 2023 and 2024.

Their single malt whiskeys done in the Scottish style originate in the brew house where they brew their wort instead of a traditional wash. Also, they have a separator that gives them the capacity to do grain distillations, which they employ for any whiskeys made with unmalted grains.

Their current whiskeys include Blenders, a collaboration done with Westland Distillery that consists of a blend of eight Westland barrels and eight Talking Cedar barrels aged between two and nine years in a mix of 1st- and 2nd-fill charred American oak casks. Future plans include adding rye whiskey to their portfolio, as well as continuing to experiment with other Pacific Northwest grains.

Contract Distilling and Brand Partnerships

In addition to producing their own beers and spirits, Talking Center also provides contract distillation for select industry partners. For example, Seattle-based Copperworks Distilling Company used to brew wort for their American Single Malt whiskeys. Among their brewing and distilling partnerships include work with Livewire’s RTD cocktails, Bird Creek’s Single Malt whiskey, Pacific Northwest Beer, Packwood Brewing Co., Douglas Lagered Beer, and Three Magnet’s Self-Care non-alcoholic beer.

Hoffman notes they won’t be at capacity for quite some time. “I’m impressed by the scale of ambition and equipment at Talking Cedar and feel it has the potential to become one of the United States’ foremost distilleries,” he opines.

Connecting with the Community

Producing award-winning products, the tribe also strives to do good with their products as all profits from their beers and spirits go towards humanitarian and cultural preservation initiatives on the Chehalis reservation. These programs include teaching their ancestral Chehalis language to the younger generation, as well as supporting initiatives to revive Chehalis leatherworking and weaving.

Their location in Rochester, WA is situated halfway between Seattle, Washington, and Portland, Oregon. This proximity to two urban cities enables them to market themselves as a destination hub easily accessible for a day trip or a weekend getaway. Guests can stay at the tribe’s 170-room Eagles Landing hotel or the 400-room family-friendly resort and waterpark called Great Wolf Lodge while enjoying the tribe’s multiple restaurants and an adults-only casino.