By: Kris Bohm: Distillery Now, LLC

Just about anyone you meet who says they like whiskey has probably heard of single malt whiskey. When it comes to whiskey in America, bourbon is the undisputed reigning champion in sales, with Canadian whiskey right behind it. There are many craft distilleries making bourbon and rye whiskey, but there are not nearly as many distilleries making single malt whiskey. American single malt whiskey is a lesser known subcategory of whiskey and is growing quickly in popularity. American single malt whiskey, or ASMW, is a unique spirit made in America from malted barley. ASMW presents an opportunity for distillers to show creativity with a whiskey whose flavor profile is far different from the wood dominant flavor profile that most American whiskies exhibit. Let’s explore what ASMW is by examining the rules that define the spirit and how it is typically made. With this understanding, let’s meet the people who are leading this newly emerging spirit category. By developing an understanding of ASMW we hope to give you the confidence to consider making malt whiskey and joining this new spirit category.

Redefining Single Malt

The average consumer of spirits logically assumes that single malt whiskey is just another phrase for Scotch whiskey. In liquor stores and bars, Scotch is the predominant malt whiskey that people see. While Scotch is malt whiskey, not all malt whiskey is Scotch. Malt whiskey is defined by the ingredient used in production, malted barley. And to further specify, malt whiskey that uses only whiskey from one distillery is known as single malt whiskey. While it is beneficial to the distillers and producers in Scotland to imply their region is what makes Scotch, well, Scotch, it is in fact the ingredients and production methods that make a great malt whiskey a single malt whiskey. American single malt whiskey strives to break away from Scotch whiskey and become a separate, recognized category.

Defining the Spirits

Malt whiskey is defined by the TTB in The United States as a whiskey that is made from at least 51% malted barley and aged in new American oak barrels. This definition does not meet the expectation of most consumers or distillers of malt whiskey. This standard of identity has held back the potential for malt whiskey made in America to be the best whiskey possible. Most malt whiskey made outside America is made from 100% malted barley aged in used barrels. American single malt whiskey does not have a legal definition. This is a hurdle to the spirit becoming an accepted category of whiskey. Several American distillers and their respective distilleries have banded together to form the American Single Malt Whiskey Commision in 2016. The mission of ASMWC is to establish, promote, and protect the category of American single malt whiskey. Prior to 2016 there were already distilleries producing malt whiskey in America, but most distillers felt the TTB standard of identity was outdated. The goal of establishing the commission was to define a unique standard of identity and type to allow ASMW to be the best whiskey possible. The ASMWC set forth and created new standards of identity for American single malt whiskey and is working with the TTB to incorporate those standards into federal guidelines.

AMERICAN SINGLE MALT WHISKEY COMMISSION

NEWLY PROPOSED STANDARD OF IDENTITY

MADE FROM 100% MALTED BARLEY

________________________________________

DISTILLED ENTIRELY AT ONE DISTILLERY

________________________________________

MASHED, DISTILLED, AND MATURED IN

THE UNITED STATES OF AMERICA

________________________________________

MATURED IN OAK CASKS OF A CAPACITY

NOT EXCEEDING 700 LITERS

________________________________________

DISTILLED TO NO MORE THAN 160 (U.S.)

PROOF (80% ALCOHOL BY VOLUME)

________________________________________

BOTTLED AT 80 (U.S.) PROOF OR MORE

(40% ALCOHOL BY VOLUME)

These proposed standards of identity are thoughtful with specific intent, laid forth by the distillers who wrote them. This new proposal came together to allow for creativity in the hands of those producing the whiskey within this standard of identity.

How is ASMW Made?

For the sake of discussing single malt production methods, we will give an overview of the traditional method of distilling malt whiskey as it is done in Scotland.

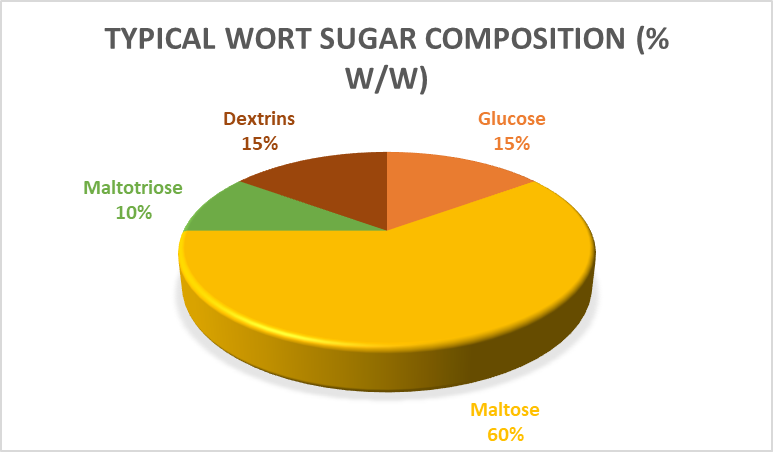

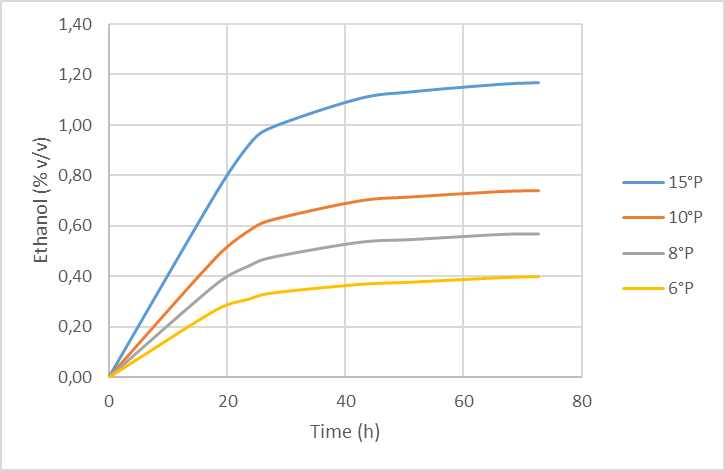

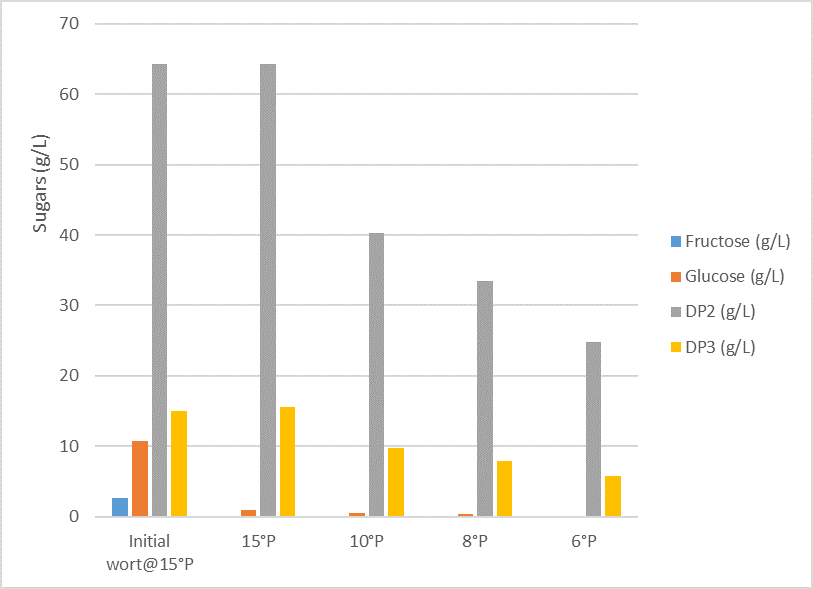

Malted barley is crushed by a mill and mixed with hot water. This hot water and barley mixture is mixed in a vessel called a lauter tun. This lauter tun separates the sugary liquid (called wort) from the barley. As the wort is drained away from the grain it is cooled off and transferred to a fermentation vessel. The fermentation takes place and the sugar in the wort is consumed by yeast to become alcohol and carbon dioxide. This now fermented beverage is referred to as distiller’s beer or wash. The alcohol content of the wash will vary but can be as low as 5% to upwards of 12%. The wash is pumped to a still where the alcohol is distilled out of it. This alcohol, also known as white whiskey, is then placed in barrels to age. The ABV of the whiskey entering the barrel will vary for some folks as low at 50% to upwards of 75% ABV. This process is a very general overview. There are many different ways to go about producing malt whiskey, and most distillers all have unique processes that produce amazing spirits.

The Folks Behind ASMW

Steve Hawley is the vocal individual who is leading the charge of the American Single Malt Whiskey Commision. Steve, who is the president of the commission, had much to say about ASMW. On the growth of this newer whiskey category, Steve credited the distillers producing the spirits and working to grow their brands as the primary force growing the ASMW category. Hawley went further to talk about the future of single malt, saying he believes that for single malt to grow and reach the levels of popularity of other whiskies that single malt producers must be unified in the language of how they promote their spirits. Being a member of the commission is a great step for distilleries to be a part of this new category. Hawley also pointed out that the key to unlock more category growth is for distilleries to focus and educate the consumer on what ASMW is.

In the state of Oregon and beyond Rogue Ales and Spirits is well known for their beer and whiskies. In a discussion with Jake Holshue, the Head Distiller for Rogue Spirits in Oregon, Holshue had the following to say. American single malt is best kept simple. Good base malt makes exceptional single malt whiskey. Holshue has years of experience producing single malt whiskey and has learned many things the hard way through experimentation. “Don’t add chocolate malt and definitely do not add hops,” says Holshue, “These unnecessary ingredients can ruin the magic of good whiskey made from malted barley.” Jake’s perspective on producing a wonderful ASMW is summed up well, “You should keep it simple.”

One of the pioneers that started production of ASMW early on is the founder of Santa Fe Spirits, Colin Keegan. Santa Fe Spirits opened in 2010 in New Mexico and produces a whiskey called Colkegan. Their particular ASMW is made from malted barley with a portion of the malt being mesquite smoked. This whiskey is reminiscent of a smokey Scottish whiskey, but their smoke carries flavors of southwest mesquite instead of traditional Scottish peat. Colkegan is firmly rooted in the traditions of Scottish single malt production, but the use of mesquite smoke and dry New Mexico climate has created a whiskey that is truly unique.

When it comes to whiskey in America there is no question that ASMW is a fast growing category with many new entrants. While there are many craft distilleries making bourbon and rye whiskey, there are not nearly as many making ASMW. This category of whiskey has big opportunities for a distillery that does not necessarily exist in other categories of spirits. As more brands become established players in the whiskey business ASMW and the demand for it will continue to grow. We highly encourage you to join the American Single Malt Whiskey Commision to help be a part of the collective voice of distillers. If you are just considering making single malt whiskey and not sure where to start you can contact the author for more info. There is no doubt that ASMW is the next big trend in whiskey. Are you ready to be a part of it?

The author of this article is Kris Bohm, owner of Distillery Now Consulting LLC. When Kris is not helping distilleries he can often be found seeking out adventures on two wheels, or defending his beer mile record.