When wastewater projects actually pay for themselves

By Frances Tietje Wang

As the beverage industry moves further into an era of necessary efficiency to accommodate skyrocketing costs, wastewater management cannot be an overlooked utility function. Aging municipal infrastructure, rising treatment costs, and stricter enforcement of industrial pretreatment requirements have pushed utilities to the forefront of operational and financial concerns. Under the U.S. Environmental Protection Agency’s (EPA) National Pretreatment Program, facilities exceeding domestic-strength benchmarks for biochemical oxygen demand (BOD), total suspended solids (TSS), or allowable pH ranges may face surcharges, permit modifications, or enforcement actions.

This regulatory pressure coincides with broader business expectations. Wastewater performance now sits at the intersection of financial risk, regulatory compliance, and sustainability reporting. As production varies and the market remains unpredictable with cost pressure and uncertainty, sewer bills continue to fluctuate, impacting overhead costs and future planning. Compliance failures can delay expansions, harm government relations, and/or require capital upgrades under compressed timelines. At the same time, water and wastewater metrics are now standard components of sustainability benchmarking and ESG (environmental, social, governance) disclosures in the brewing sector.

As a result, wastewater investments are no longer evaluated primarily as environmental gestures. The strategic question has become whether a given project delivers measurable return on investment (ROI) and protects long-term operational viability.

Defining “Payback” in Wastewater Projects

In beverage production, payback extends beyond a simple comparison of capital expenditure (capex) and operating expense (opex). Direct savings commonly include reduced BOD and TSS surcharges, avoiding penalties for noncompliance, and lower costs associated with chemical neutralization or off-site hauling. These kinds of savings align with municipal cost-recovery frameworks, which are embedded in federal pretreatment regulations 40 CFR Part 403, which is designed to prevent interference with publicly owned treatment works.

“Wastewater investments are no longer evaluated primarily as environmental gestures. The strategic question has become whether a given project delivers measurable return on investment (ROI) and protects long-term operational viability.”

Indirect value is often more consequential. Stable wastewater systems can reduce unplanned downtime, protect discharge permits, and preserve expansion capacity. In fact, research has shown that wastewater constraints frequently become limiting factors for brewery growth before brewhouse or fermentation capacity is exhausted.

Across utility data and academic literature, payback timelines cluster by project type. Pretreatment, solids capture, and flow-equalization projects commonly can achieve ROI payback within 1 to 3 years, whereas anaerobic digestion and water reuse systems often require 3 to 7 years. These all depend on scale, incentives, and local rate structures.

High-ROI Wastewater Projects Breweries and Distilleries Are Actually Using

Solids Capture and Flow Equalization: Upstream solids capture combined with flow equalization remains one of the most reliable ROI drivers in brewery and distillery wastewater management. Methods such as screening, settling, and rotary drum filtration reduce TSS loading before wastewater reaches municipal systems. This results directly in lowering surcharge exposure and downstream treatment demand.

Flow equalization further improves economics in smoothing short-duration load spikes associated with cleaning-in-place (CIP), yeast removal, or batch discharges. EPA guidance emphasizes that stabilizing hydraulic and organic loading often provides greater compliance benefit than adding downstream treatment capacity, particularly for batch-driven industries such as brewing and distilling (EPA, 2000).

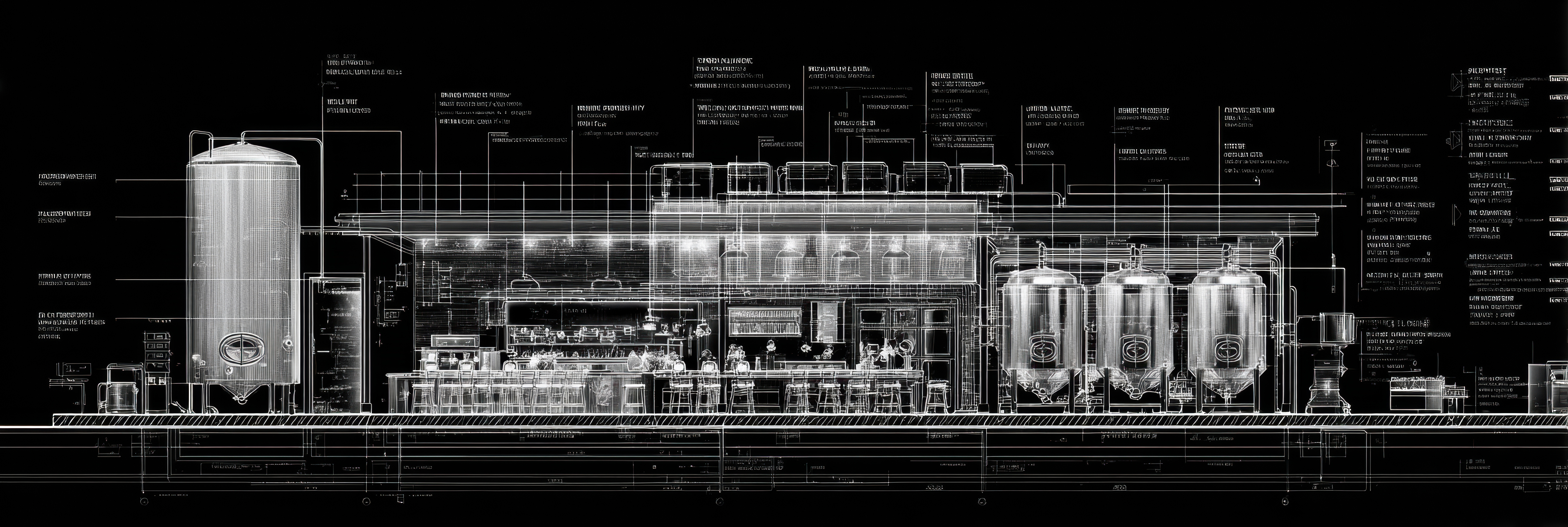

This approach is reflected in brewery practice, as at Sierra Nevada Brewing Co., which documents wastewater treatment and solids management as integral components of its sustainability strategy. At the facility in Mills River, North Carolina, wastewater treatment infrastructure is embedded into site design rather than treated as an afterthought.

pH Neutralization and Smart CIP Controls: pH excursions remain among the most common enforcement triggers in municipal pretreatment programs. Extreme pH changes can inhibit biological treatment and damage sewer infrastructure. By using methods such as automated pH neutralization, conductivity-based diversion, and smart CIP controls, it is possible to reduce reliance on operator intervention and lower the likelihood of violations.

Scholarly reviews consistently describe brewery wastewater as highly variable, driven by batch operations, product losses, and cleaning cycles. The best option for managing these sources is in upstream practices, which is often more effective than relying solely on end-of-pipe corrections. Industry guidance reinforces optimizing sanitation chemistry and discharge timing, some of the most cost-effective wastewater interventions available.

Anaerobic Digestion

(When It Makes Sense)

Anaerobic digestion (AD) can deliver strong returns when organic loading is sufficiently high and consistent. The U.S. Department of Energy identifies beverage production as a sector with meaningful biogas potential, in particular where waste streams are concentrated and predictable.

New Belgium Brewing is a well-documented example of anaerobic digestion. Trade engineering publications and supplier case studies describe how the brewery integrates anaerobic wastewater treatment and biogas recovery. In combining these two methods, the organic load is reduced while generating renewable energy, supporting both environmental performance and long-term cost control.

Distilleries, which typically generate higher-strength effluent than breweries, often reach economic thresholds for AD more readily. Breweries may achieve viability at larger scales or through co-digestion strategies, but it is important to note that the literature says that AD economics depend on operational discipline, energy pricing, and access to incentives.

Water Reuse and

Process Water

Reduction

Water reuse strategies, such as rinse recovery or reuse for non-product-contact utilities, can reduce both freshwater intake and wastewater discharge. The EPA’s Water Reuse Action Plan emphasizes “fit-for-purpose” treatment. The Plan discusses matching reclaimed water quality to its intended application rather than defaulting to over-treatment.

Eel River Brewing Company is an excellent example of how small breweries have implemented reuse-adjacent strategies without complete reuse systems.

By incorporating pretreatment infrastructure to reduce municipal impact and comply with discharge permitting requirements documented in municipal engineering analyses, the brewery illustrates how wastewater investment can scale to smaller producers when aligned with operational needs.

Economic analyses indicate that reuse projects are most viable in regions with high water and sewer rates or where discharge capacity is constrained, and when integrated into broader water-efficiency programs rather than pursued in isolation.

Grants, Incentives, and Financing: The Hidden ROI Multiplier

Technically sound wastewater projects proceeding are often determined by grants or low-interest financing if capital costs exceed internal investment thresholds. In the United States, the Clean Water State Revolving Fund (CWSRF) remains the primary financing mechanism for wastewater infrastructure, including eligible pretreatment and reuse projects.

Energy recovery projects may qualify for additional incentives through state or utility programs. The Database of State Incentives for Renewables & Efficiency (DSIRE) is widely used to identify applicable funding opportunities and rebates.

Producers who successfully secure funding tend to align wastewater projects with municipal objectives, such as reducing peak loading or deferring treatment plant expansion, rather than aspirational narratives. They may also use support applications with documented monitoring data rather than aspirational sustainability narratives.

Case Study Patterns: Making the Math Work, Not Waste

Across scholarly literature and industry documentation, three recurring patterns emerge:

1. Breweries implement solids capture and equalization, which consistently reduce surcharge exposure by stabilizing discharge characteristics.

2. Distilleries and large breweries integrate anaerobic digestion with energy recovery. AD can offset both wastewater and energy costs when scale and incentives align.

3. Mid-size producers leveraging CWSRF financing and state incentives frequently offsetting 30–50% of capital costs, bringing payback into acceptable ranges.

In layering strategies, there is an opportunity for immediate and long-term cost savings.

Wastewater

as Strategic

Infrastructure

Wastewater management has evolved from a compliance cost into strategic infrastructure. Breweries and distilleries that invest in the fundamentals of solids capture, equalization, smart controls, and right-sized recovery systems can reduce financial volatility, strengthen regulatory standing, and preserve growth capacity. As scrutiny tightens and costs rise, wastewater planning is no longer optional sustainability branding; it is a survival strategy for an operational reality.

Resources

Fillaudeau, L., Blanpain-Avet, P., & Daufin, G. (2006). Water, wastewater and waste management in brewing industries. Journal of Cleaner Production, 14(5), 463–471. https://doi.org/10.1016/j.jclepro.2005.01.002

Sierra Nevada Brewing Co. (n.d.-a). Sustainability. https://sierranevada.com/sustainability