The power of manifestation through positive affirmation

By Raj Tulshan, Founder & Managing Partner, Loan Mantra

New year, new you! A new year brings the opportunity for a business refresh and positive change. Many Americans turn the calendar and plan New Year’s resolutions as rite of passage each year. But planning and keeping these resolutions is often easier said than done. However, a Quickbooks survey indicates that business owners may carry higher levels of ambition than those with no entrepreneurial interest. Business owners are more likely to make (and stick to) financial goals than the average consumer—65% say they tend to keep their financial resolutions.1

Interestingly, new data also shows that what’s on the mind of business owners in 2026 is different than in year’s past. New Year’s Resolutions made for 2026 reveal notable shifts in how business owners view the current business climate and what priorities matter when compared to resolutions that were made in previous years.

Prior to 2026, we see resolutions centered on increasing sales, improving marketing efforts, cutting costs and boosting efficiency. In contrast, 2026 New Year’s Resolutions are more future focused with long-term thinking in mind. Goals for 2026 focus on building financial resilience, accelerating adoption of smart tools and technology, strengthening digital presence, sustainability and investing in workplace culture and people says findings from a Bank of America Study. The research further reveals that 74% of small and midsize business owners anticipate revenue growth in 2026 with over half, (60%) planning to expand their operations.2

So, what is the key takeaway? A renewed focus on the positive in the business landscape.

A Positive Focus

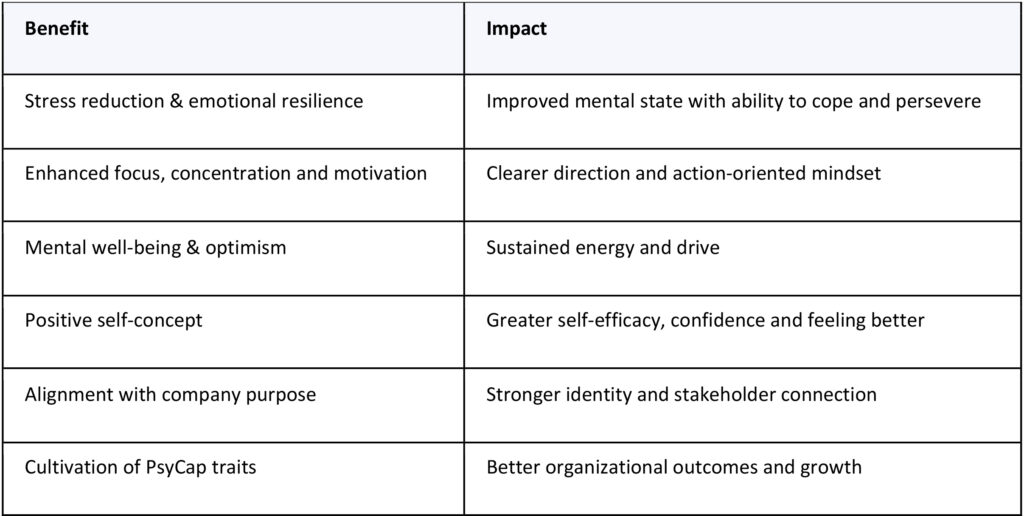

Focusing on the positive, re-enforcing and repeating positive statements, or affirmations can have a powerful effect. Studies indicate that affirmative self-talk can re-wire critical neurotransmitters that fuse connections together in the brain. Writing down these affirmations further engages the reward and self-processing areas of the mind, enhancing concentration, improving performance under stress. Positive affirmations don’t just feel good—there’s research to back up their many benefits. Whether it’s improving mental well-being, shaping attention toward success-oriented actions, or aligning with a deeper purpose, the benefits are real and the impact is measurable.

A Mindful Purpose

Developing a mantra is one way to use positively focused affirmations with intention. The word mantra originated in India and was derived from combining the Sanskrit, root word man- “to think” and -tra meaning, “tool”, together to mean “instrument of thought” or tool for the mind. Hinduism, Buddhism and Jainism use mantras as part of sacred ancient practices to harness spiritual power and alter consciousness. Sikhism, Zoroastrianism, Islam and Christianity also use a similar idea of repeating words, either a prayer or phrase to bring enlightenment or as way to worship.

In the secular space, mantras serve a variety of functions and are especially popular as aids to help mindfulness, deepen concentration and increase awareness. In business, a mantra is a future-focused statement that defines your business as you want it to be. Clarity of your business purpose is not only important to business owners, employees, and shareholders, but clients and potential customers too. Research by McKinsey shows that 82% of respondents say purpose statements are important in business, and 72% believe purpose should outweigh profit.3

Mantras help shape what we notice and focus on collectively in a positive direction. Psychologists call this confirmation bias. This means your brain starts noticing and signaling opportunities that align with your desired outcome. Practicing and repeating mantras helps replace negative thoughts with positive ones, encouraging optimism, resilience, and growth. In a study done with U.S. Veterans, mantra repetition was associated with greater reductions in post-traumatic stress disorder (PTSD) symptoms and anger and helped improve mental health.

Team Alignment for Successful Outcomes

Mantras are part of our company culture and belief systems – so much so, that we use this practice daily. We are convinced of the power of positive suggestion and manifestation, which have made a big impact on our growth. When creating our mantra, we wanted to convey how our human expertise, secure technology, and painless platform allow borrowers, lenders, and partners to fund loans easily and efficiently anytime and anywhere. With this in mind, we created the mantra: Democratized lending for all.

Business owners and leaders are discovering the performance secrets that elite athletes already know.5 Intentional thoughts or minding your mantra, repetition, and focusing on the desired outcome can help manifest your dreams in personal and professional life, leading you on the road to victory and long-term value.

How to Create Your Own business Mantra

Ready to develop a business mantra that reflects your company? The first step is to write a few short powerful phrases that capture the essence of your business. Ask yourself (and maybe grab partners, customers or associates to help) — why does your business exist, who do you serve, what sets you apart and what feeling you deliver. Think beyond the obvious answers. To create a compelling business mantra, follow these steps:

1. Craft Short, Powerful Phrases: Begin by capturing the essence of your business in just 2-5 words. Reflect on your core purpose, the audience you serve, and the impact you wish to make. Keep in mind that a mantra is more than a tagline—it’s an expression of your business’s truth.

2. Clarify Your Why: Articulate the true impact of your business in 1-2 concise sentences. For instance, you might say, “We help small businesses feel confident managing their finances.” This step requires you to dig deep into the real reason your business exists and the difference it makes.

3. Define Your Audience and Impact: Specify who your audience is and what you offer them. Consider the transformation or change your brand brings to your customers. An example statement could be, “We turn confusion into clarity.” This ensures that your mantra is aligned with the needs and experiences of your audience.

4. Describe Your Actions:

Use strong, active language to describe what your business does. Choose words that are bold and human. Examples of action-oriented phrases include Inspire Confidence, Simplify Growth, or Empower Every Client. These should reflect the dynamic actions your business takes to achieve its goals.

5. Choose the True Mantra: Gather feedback from your team or customers to ensure your chosen mantra resonates well with them and aligns with your brand values. This collaborative step helps in fine-tuning your mantra to reflect the collective vision of your business.

6. Test, Trial and Use Your Mantra: Say your mantra aloud to confirm it energizes and motivates you. Integrate it into your internal materials and use it as a guide in decision-making processes. Consistently reinforce it within your company culture and marketing efforts to ensure it becomes an integral part of your business identity.

For more information contact Raj Tulshan the author, visit loanmantra.com or https://www.linkedin.com/in/tulshan/.

Sources:

1. QuickBooks. “Entrepreneurship in 2025: The Trends and Insights You Need to Know | QuickBooks.” Intuit.com, 17 Dec. 2024, quickbooks.intuit.com/r/small-business-data/entrepreneurship-in-2025/#resolutions. Accessed 20 Nov. 2025.

2. “BofA Report: 74% of Small and Mid-Sized Business Owners Expect Revenue to Increase in the next Year.” Bank of America, 2025, newsroom.bankofamerica.com/content/newsroom/press-releases/2025/11/bofa-report–74–of-small-and-mid-sized-business-owners-expect-r.html. Accessed 20 Nov. 2025.

3. Mckinsey. “Corporate Purpose: Shifting from Why to How | McKinsey.” Www.mckinsey.com, 22 Apr. 2020, www.mckinsey.com/capabilities/people-and-organizational-performance/our-insights/purpose-shifting-from-why-to-how.

4. Malaktaris A, McLean CL, Mallavarapu S, Herbert MS, Kelsven S, Bormann JE, Lang AJ. Higher frequency of mantram repetition practice is associated with enhanced clinical benefits among United States Veterans with post-traumatic stress disorder. Eur J Psychotraumatol. 2022 Jun 10;13(1):2078564. doi: 10.1080/20008198.2022.2078564. PMID: 35713599; PMCID: PMC9196752.

5. Hatzigeorgiadis, A., Zourbanos, N., Galanis, E., & Theodorakis, Y. (2011). Self-Talk and Sports Performance: A Meta-Analysis. Perspectives on Psychological Science, 6(4), 348-356. https://doi.org/10.1177/1745691611413136 (Original work published 2011)